Get the free notarized financial statement

Show details

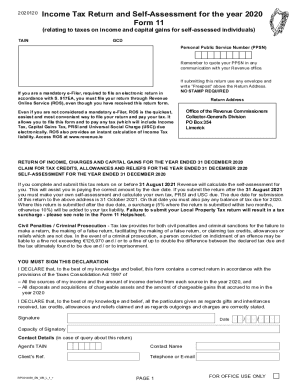

FINANCIAL STATEMENTS NOTARIZATION FORM. This is to certify that the enclosed financial statements for name of school or corporation for the period ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign notarized letter for proof of income form

Edit your notary statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to notarize a bank statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notarized bank statement online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit notarized income statement form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Financial Statements Notarization Form

How to fill out notarized financial statement?

01

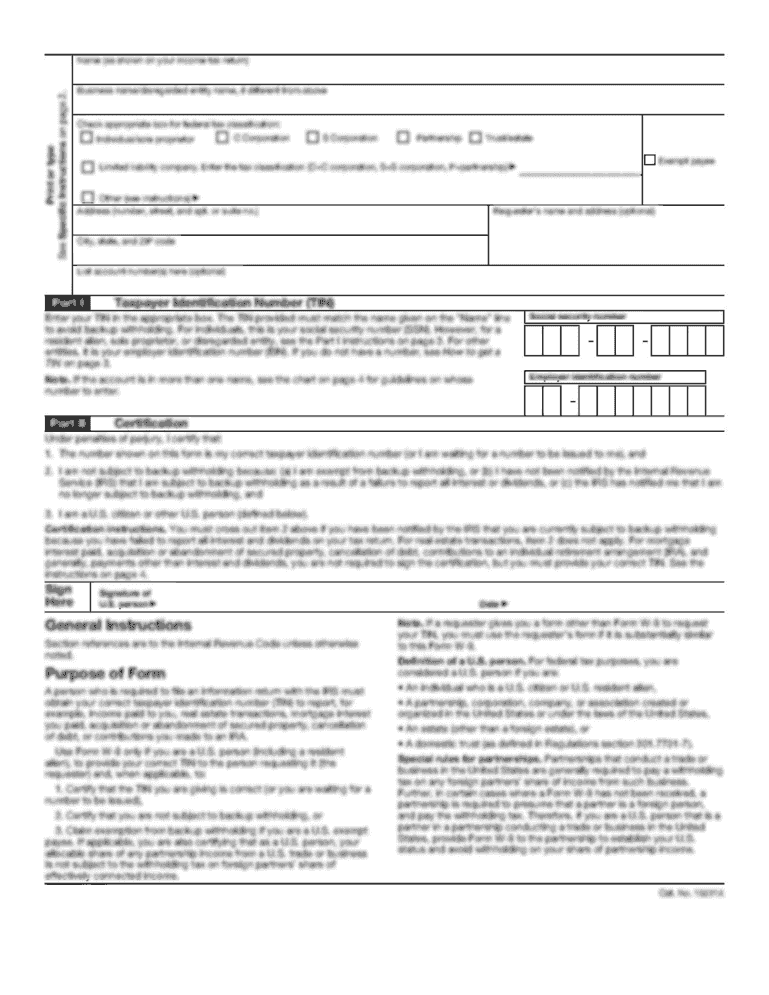

Gather all necessary financial documents such as bank statements, tax returns, pay stubs, and investment statements.

02

Carefully review the notarized financial statement form and ensure you understand all the sections and information required.

03

Start by filling out your personal information including your name, address, contact details, and Social Security number.

04

Provide accurate details about your employment, including your job title, employer's name, and address.

05

In the income section, list all sources of income such as salary, bonuses, rental income, or any other form of monetary gains.

06

List all your assets, including real estate, vehicles, investments, and any other valuable possessions you own.

07

Disclose all your liabilities, including mortgages, loans, credit card debts, or any other financial obligations.

08

Clearly state your monthly expenses, including housing costs, utilities, transportation, food, medical expenses, and any other regular expenses.

09

If applicable, provide information about any other financial support you receive, such as alimony, child support, or government assistance.

10

Review the completed notarized financial statement form for accuracy and completeness.

11

Sign the financial statement in front of a notary public while providing valid identification.

12

Pay the necessary fees for the notary service, if applicable.

Who needs notarized financial statement?

01

Individuals applying for a loan from a financial institution may be required to submit a notarized financial statement as part of the application process.

02

Participants in legal proceedings, such as divorce or child custody cases, may need to provide a notarized financial statement to disclose their financial situation.

03

Some government agencies may request a notarized financial statement to determine eligibility for certain benefits or assistance programs.

04

Small business owners or entrepreneurs may need to present a notarized financial statement when applying for business loans or seeking potential investors.

05

Individuals involved in real estate transactions, such as buying or selling properties, may be asked to provide a notarized financial statement to ensure financial stability and credibility.

06

Some educational institutions may require a notarized financial statement from students or their parents to assess financial need and determine eligibility for financial aid or scholarships.

Fill

form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Financial Statements Notarization Form in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your Financial Statements Notarization Form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit Financial Statements Notarization Form in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your Financial Statements Notarization Form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the Financial Statements Notarization Form in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your Financial Statements Notarization Form and you'll be done in minutes.

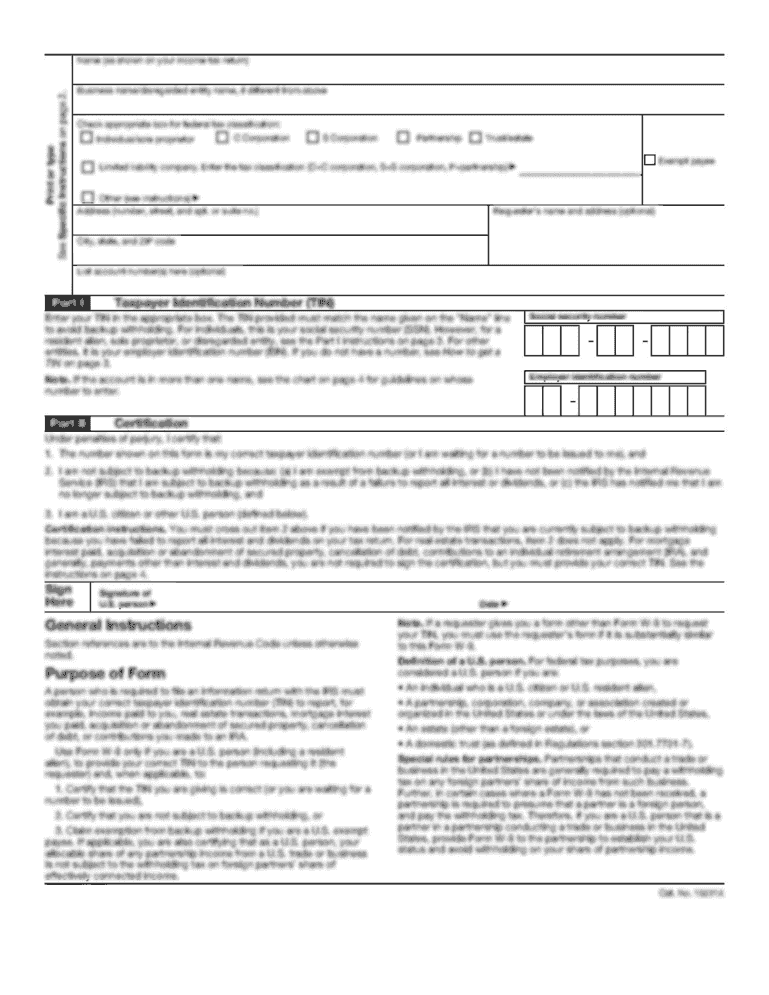

What is Financial Statements Notarization Form?

The Financial Statements Notarization Form is a legal document used to verify the authenticity and accuracy of financial statements by requiring notarization from a licensed notary public.

Who is required to file Financial Statements Notarization Form?

Entities such as corporations, limited liability companies, or partnerships that prepare financial statements for regulatory, compliance, or legal purposes are typically required to file the Financial Statements Notarization Form.

How to fill out Financial Statements Notarization Form?

To fill out the Financial Statements Notarization Form, the entity must provide its basic information, attach the completed financial statements, and include the notary acknowledgment section for the notary to complete.

What is the purpose of Financial Statements Notarization Form?

The purpose of the Financial Statements Notarization Form is to ensure the reliability and integrity of financial disclosures, making them trustworthy for stakeholders, compliance purposes, and legal requirements.

What information must be reported on Financial Statements Notarization Form?

The Financial Statements Notarization Form must report the entity's name, address, date of financial statements, the nature of the financial statements, and include a notary acknowledgment signature and seal.

Fill out your Financial Statements Notarization Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statements Notarization Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.